Table Of Content

Some features of the online application are not available with all loans; talk to a home mortgage consultant. There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation. If credit card debt is holding you back from getting to 36%, you might want to consider a balance transfer. You can transfer your credit card balance(s) to a credit card with a temporary 0% APR and pay down your debt before the offer expires. The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a home doesn’t necessarily mean that you have to jump into homeownership.

Mortgages

B.C. First-Time Home Buyer Guide - NerdWallet

B.C. First-Time Home Buyer Guide.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]

Rates, program terms and conditions are subject to change without notice. An adjustable-rate mortgage might have a lower rate than a fixed-rate mortgage at first. But over time, the rate on an adjustable-rate mortgage could go up by a lot, while the rate on a fixed-rate mortgage would remain the same. The higher your credit score, the better the interest rate you are offered; therefore, you might be able to own a higher priced home than someone with a low credit score. A general guideline when calculating how much home you can afford with your salary is to multiply your income by at least 2.5 or 3. This should give you an idea of the maximum housing price you can afford.

Buying a House

Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan. Private mortgage insurance (PMI) is required for borrowers of conventional loans with a down payment of less than 20%.PMI typically costs between .05% to 1% of the entire loan amount. Although PMI raises your monthly payment, it may allow you to purchase a home sooner, which means you can begin earning equity. It’s important to speak to your lender about the terms of your PMI before making a final decision. And don’t forget you’d also need to pay a down payment and closing costs upfront, while keeping enough leftover to cover regular maintenance, upkeep and any emergency repairs that may arise.

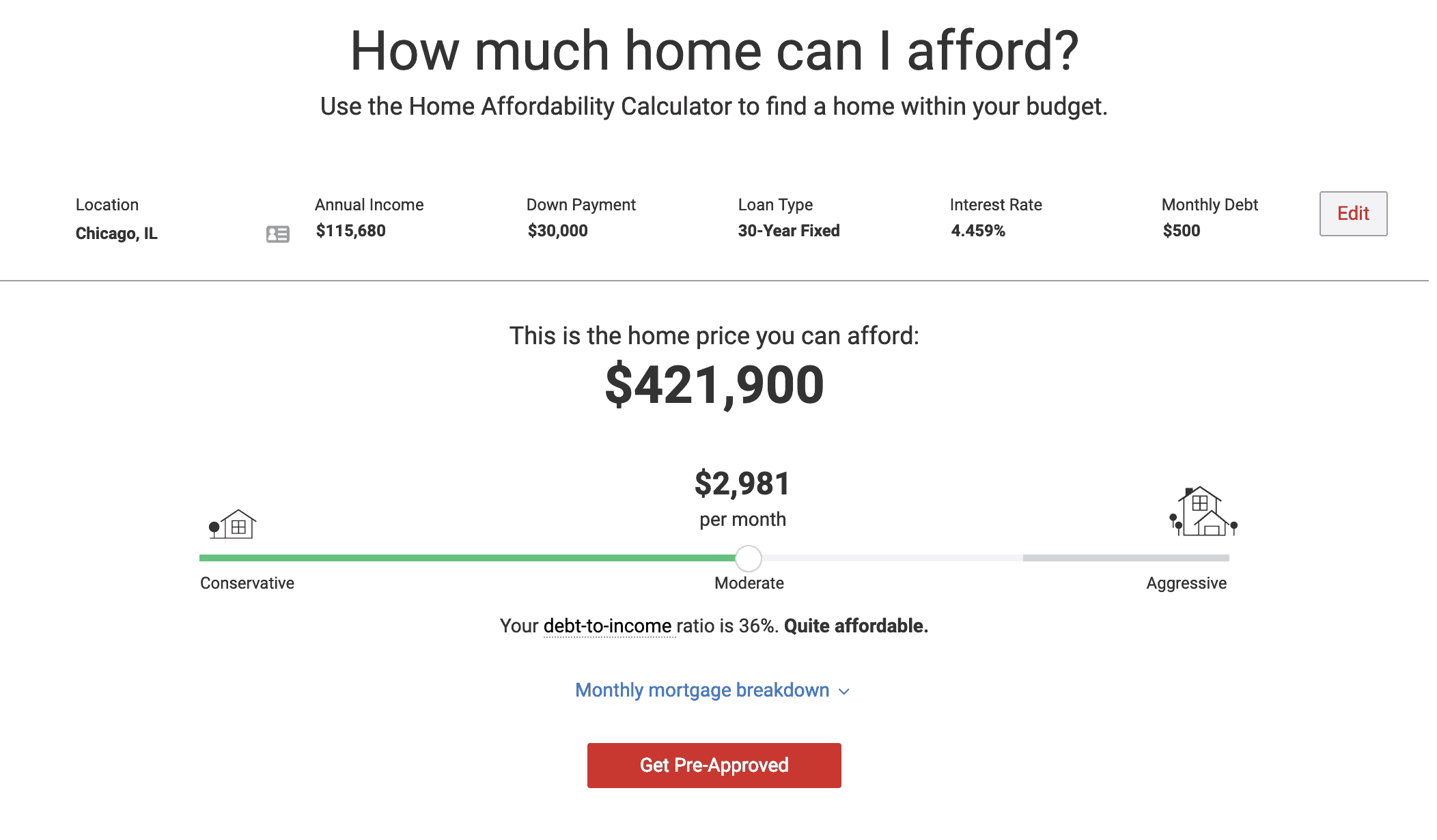

See what you can afford and find homes within your budget.

The organization offers help with securing a home loan as well as up to 4% down payment assistance in the form of a non-repayable grant. The state also runs the Department of Consumer Affairs Bureau of Real Estate. This entity was created to protect public interest and increase consumer awareness in real estate transactions. Apply online for expert recommendations with real interest rates and payments. All home lending products except IRRRL (Interest Rate Reduction Refinance Loan) are subject to credit and property approval.

On the other hand, if you wait to buy a home, you won’t start building equity. Because building equity can grow your net worth and give you better borrowing options, you may be better off if you begin that process sooner rather than later. Here are some factors that can influence the interest rate you’re offered. Budget 1% to 4% of your home’s value each year for home maintenance. You might not spend this amount each year, but you’ll spend it eventually. By refinancing an existing loan, the total finance charges incurred may be higher over the life of the loan.

You’ll need to also consider how the VA funding fee will add to the cost of your loan. This is based on our recommendation that your total monthly spend for your monthly payment and other debts should not exceed 36% of your monthly income. To find your debt-to-income ratio, first add together all of your monthly debt payments. For example, if you pay $200 each month on a student loan, $400 on a personal loan and $500 on an auto loan, your total debt payments are $200 + $400 + $500, which equals $1,100.

If these prove to be difficult, home-buyers can maybe consider less expensive homes. If not, there are various housing assistance programs at the local level, though these are geared more towards low-income households. Renting is a viable alternative to owning a home, and it may be helpful to rent for the time being in order to set up a better buying situation in the future. For more information about or to do calculations involving rent, please visit the Rent Calculator.

Monthly debts

How Much House Can I Afford On A $120K Salary? - Bankrate.com

How Much House Can I Afford On A $120K Salary?.

Posted: Tue, 03 Oct 2023 07:00:00 GMT [source]

Home price on the map reflects typical value for homes in the 35th to 65th percentile range collected by Zillow as of Februay 2022. In December 2022, the overall unemployment rate for California was 4.1% compared to the national rate of 3.5%, according to the Bureau of Labor Statistics. However, California's per capita personal income in 2021 was $76,614, while the national average was $65,148, based on data from the U.S. Although the Golden State has high taxes, it does play host to a number of bustling industries. Data from Statista.com shows the state is tied with New York for the most Fortune 500 company headquarters at 53. However, the housing market is especially tough in coastal areas, where about two-thirds of the population lives.

Homeowners Insurance

Your other two options, pay off debt and increase income, take time. Perhaps you need to make a budget and a plan to knock out some of your large student or car loans before you apply for a mortgage. Or you wait until you get a raise at work or change jobs to apply for a mortgage. At a minimum, it’s a good idea to be able to make three months’ worth of housing payments out of your reserve, but something like six months would be even better. That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments.

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

It’s a big responsibility that ties up a large amount of money for years. But beyond that you’ve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you don’t want to buy the most expensive home that fits in your budget. Banks don’t like to lend to borrowers who have a low margin of error.

It’s important to remember that the mortgage lender is only telling you that you can buy a house, not that you should. That’s why it can make a significant difference if you make even small extra payments toward the principal, or start with a bigger down payment (which of course translates into a smaller loan). Lenders generally want to know you will have a cash reserve remaining after you’ve purchased your home and moved in, so you don’t want to empty your savings account on a down payment. If you are spending 40% or more of your pre-tax income on pre-existing obligations, a relatively minor shift in your income or expenses could wreak havoc on your budget. Use the home affordability calculator to help you estimate how much home you can afford. In general, home-buyers should use lower percentages for more conservative estimates and higher percentages for more risky estimates.

If you can’t afford to buy a home with a conventional loan, you might benefit from one of these government loan programs designed to make home ownership more accessible. If you’re planning to buy a house, you’ll need to get a sense of how much home you can afford. You might not want to borrow the maximum amount a lender offers you.

No comments:

Post a Comment